Current status of Russian wheat exports to China

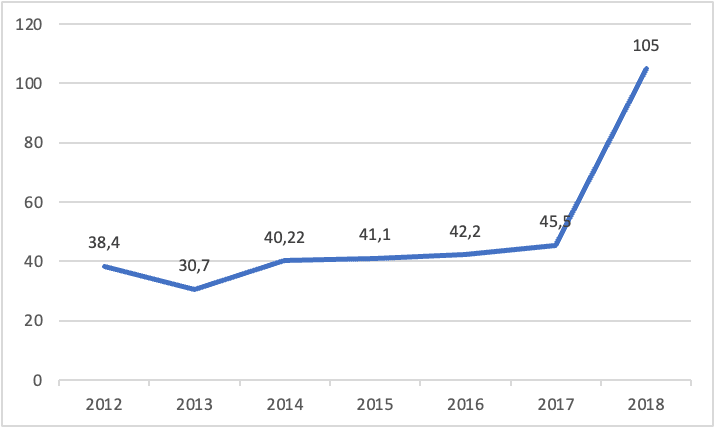

According to the Russian Export Development Center, since 2015, Russia's agricultural and sideline products, as well as livestock, agriculture and other export quantities ranked among the top in the world, according to the comprehensive data for 2020, Russia harvested a total of 133 million tons of grain for the year, of which wheat accounted for the world's total wheat exports ranked first in the world. China is the main wheat-producing country in Russia, and according to the Russian trade volume, Russia's wheat exports have increased year by year since 2012 until 2018. It reached $10.4 billion in 2018 from $3.84 billion in 2012. In particular, the existence of a significant increase in the trade value of wheat exports in 2018 shows that Russian wheat is more competitive in the market and generally shows a stable growth in development (Figure 1).

Fig. 1. Russian wheat export trade volume

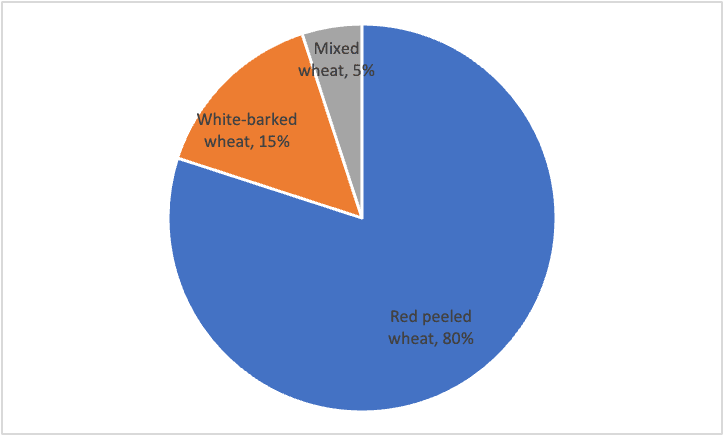

According to the statistics, the total size of Russian wheat exports to China in 2020 is 80% (Figure 2), which is a very high percentage of the wheat exported to China. In 2022, as a result of the conflict between Russia and Ukraine, Russia will mainly export red-skinned wheat to China, which will provide Russia with higher economic benefits in a shorter period of time due to its higher yield and shorter production second, although Russia has certain advantages in wheat exports, we can see from the above analysis that Russia mainly exports red-skinned wheat and there is Wheat varieties are too single, especially in the current situation of the Russian-Ukrainian conflict, in the future the two countries tend to stabilize trade, the impact of Russia's export of wheat is too single will be more exposed, affecting the overall wheat export competitiveness.

Fig. 2. Structure of Russian wheat exports

Russia in the process of export trade transactions of wheat, is bound to be affected by the Chinese government and related control measures, which are covered in Chapter 2, and the current export policy of Russian wheat is also being adjusted at any time, Russian wheat exports for control, the current Russian encouragement of wheat for export trade, strengthening the friendly and cooperative relationship between our two countries, actively promoting the share of Russian wheat exports to China, and the international market share affects the Russian exports of wheat to China, and the above are also important factors affecting the Russian exports of wheat to China.

Trends in Russian wheat trade exports to China

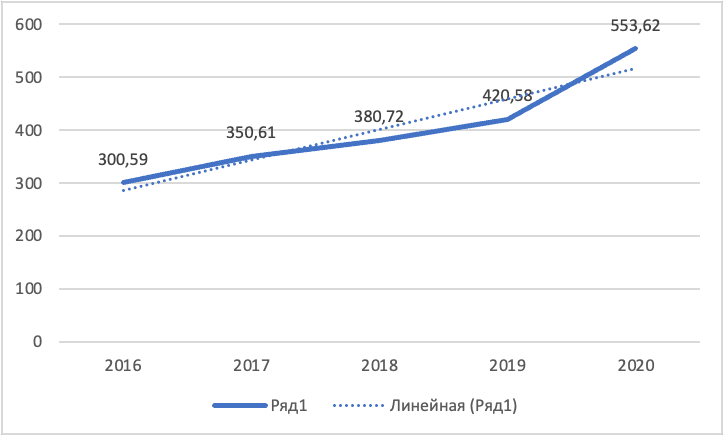

The population between China and Russia is in a growing stage, but the population growth rate in Russia is lower than the population growth rate in the Chinese country, which leads to a large shortage of wheat in China and a strong export demand from Russia, which in turn causes a friendly and cooperative relationship between China and Russia, and a higher population growth rate in China will directly affect Russia's strengthening of wheat to China export efforts and the higher price of Chinese state production wheat will put a lot of pressure on the Chinese wheat industry, thus increasing the import demand (Table 1).

Table 1

Table of wheat imports into China, 2016-2022

|

Year |

China wheat import demand (million tons) |

|---|---|

|

2016 |

300.59 |

|

2017 |

350.61 |

|

2018 |

380.72 |

|

2019 |

420.58 |

|

2020 |

553.62 |

|

2021 |

564.45 |

|

2022 |

602.79 |

Using the data in Table IV bar V for curve fitting, the sustained import demand for wheat in China in the next few years can be projected for future wheat imports (Figure 3).

Fig. 3. Future Chinese wheat imports forecast

In recent years, Russia's trade exports for China, wheat trade exports also continue to be high, due to the impact of the Belt and Road between the two countries and the impact of bilateral cooperation relations, China will continue to increase wheat trade with Russia to enhance the ability of Russia to sell wheat in China and enhance domestic demand (Table 2).

Table 2

Russian wheat exports to China (in millions of tons)

|

Year |

Russian wheat exports to China (million tons) |

|---|---|

|

2016 |

55 |

|

2017 |

60 |

|

2018 |

64 |

|

2019 |

70 |

|

2020 |

81 |

|

2021 |

85 |

|

2022 |

94 |

In recent years, Russia's trade exports to China, wheat trade exports are also continuing to go up, due to the impact of the Belt and Road between the two countries and the impact of bilateral cooperation relations, China will continue to increase wheat trade with Russia to enhance Russia's wheat sales capacity in China, to enhance domestic demand, from which it can also be seen that the trade between China and Russia will continue to advance, the future bilateral trade relations between the two countries will become better and better, Russia's wheat exports to China will reach a new high, in the next few years, Russia's total wheat exports to China is likely to reach the million ton level.

Russian production factors are not sufficiently equipped to affect the quality of wheat

(1) Production technology is not advanced enough

Production technology is the core competitiveness, which can effectively improve the quality of wheat and increase the efficiency of wheat production. When the production efficiency is high, the volume of export trade in small sales is large, and when the production efficiency is low, the volume of trade in wheat production is small. According to our examination of production technology in Russia, we found that there is a low production technology in Russia in terms of planting seeds and pesticide technology, which affects the production of wheat. The specific production technology deficiencies are reflected in the following points.

First of all, Russia's technology in seed breeding technology is low, good breeding technology can effectively improve the quality of wheat and enhance the competitiveness of wheat in the international arena, currently in the breeding process, Russia adopts a high use of technology in production, while the amount of capital investment in the cultivation of seeds is low, lack of innovation and effectiveness, or the use of more traditional breeding methods, which leads to the overall yield This has led to low overall yields and low production efficiency, which does not provide a good basis for the development of the Russian export trade and affects the development of the Russian wheat trade.

Secondly, Russia's pesticide technology in the process of wheat breeding is low, and the development of pesticides is not enough, which leads to obvious problems in wheat quality. The current level of investment in the development and development of pesticide technology in Russia is low, resulting in the overall lack of development of pesticides and lower wheat yields.

Finally, the overall wheat harvesting capacity in Russia is poor, which is directly related to the development of machinery and agricultural equipment in Russia. Only a small percentage of the population has adopted the agricultural machine harvesting technology, most of them have a large wheat production, but although they use the agricultural machine harvesting, but their agricultural equipment is still relatively backward, which also reflects the overall economic level of Russia, the use of agricultural machine technology also affects the overall efficiency of wheat harvesting in Russia.

From the above points, we can see that Russia's deficiencies in the technical elements of wheat production, including seed breeding technology, pesticide development technology and agricultural machinery technology research and development of low technology, affecting the efficiency of wheat production in Russia, which in turn has an impact on the volume of wheat trade between China and Russia.

(2) Low use of agricultural machinery in wheat production process

According to the study, Russia rarely uses agricultural machinery in the wheat planting process, wheat harvesting process, harvesting in the production process of wheat using agricultural machinery technology can effectively improve the production efficiency, most countries in the world in the production of wheat, the use of agricultural machinery and equipment are used in large quantities. Practice has proved that the use of agricultural machinery technology can greatly improve the efficiency of wheat production, while Russia uses less agricultural machinery and equipment in the process of wheat production, specifically in the following two aspects.

First, the agricultural machinery technology in the wheat planting process is outdated, Russian farmers still use the traditional manual sowing method of wheat planting, while in developed countries, they all use mechanical sowing for wheat, sowing efficiency is very high, mechanical sowing than manual sowing efficiency can be increased by more than five times, and it consumes human and material resources, in the process of wheat sowing, Russia's pesticide spraying, wheat irrigation, etc. are still the same. In the wheat sowing process, pesticide spraying, wheat irrigation and other aspects of the traditional method of operation are still used, which greatly affects the efficiency of the wheat planting process.

Secondly, Russia uses less agricultural machinery in the wheat harvesting process. The harvesting of wheat in Russia is still done manually, which is less efficient and wastes a lot of labor, and relying on manual labor alone can cause some resistance to farmers. The backwardness of agricultural harvesting technology in Russia is actually the backwardness of human thinking and the backwardness of the policy system, which also affects to some extent the total amount of wheat exported from Russia to China.

From a comprehensive point of view, the world's developed and developing countries, such as the United States, China and other countries, are a large number of agricultural machinery technology research and development, in order to increase the production efficiency of all walks of life, while Russia is currently in the wheat sowing and harvesting process, has not used enough agricultural machinery technology for efficient production, which is another important factor affecting the volume of Russian trade exports.

(3) Insufficient labor force affects wheat production

The problem of labor is mainly a human problem, the current process of wheat production in Russia, the overall labor input is low, mainly in the overall number of people in Russia and the lack of quality of labor capacity and other phenomena, resulting in the overall low efficiency of wheat production in Russia, specifically the following characteristics.

First, the overall area of the Russian regions is large, but the number of people is low and the labor force engaged in wheat production is low. From the distribution of each crop growing region in Russia, the wheat growing region is mainly concentrated in the Far East, while most of Russia's population is concentrated in the European zone, which is more suitable for people's life and better development, which leads to a smaller population in the Far East and a lack of wheat growing labor force, limiting the production capacity of wheat in Russia.

Secondly, there are fewer highly educated people for wheat cultivation in Russia. Talent is the core driver of innovation and can effectively improve wheat production efficiency, and highly skilled people can effectively improve wheat cultivation and breeding methods and have a richer knowledge base to turn knowledge into productivity. Currently, Russia is almost all low-educated farmers in terms of wheat productivity inputs, lack of expertise in wheat cultivation and wheat breeding, many highly skilled people are not willing to work in the wheat industry, and few are willing to learn wheat cultivation techniques, wheat breeding in this case will greatly affect the quality of wheat and the sustainability of wheat production land, limiting the development of wheat scale.

Finally, very few people in Russia are currently willing to engage in the wheat industry, most young people have gone to work in industries with more future prospects, most people think that wheat is a farmer's business and do not recognize the future potential of agricultural products planted in the wheat growing process, there are already fewer young people willing to engage in the production of agricultural products, which is also an important factor that plagues the development of wheat in Russia (Table 3), but As a result of the recent Russian-Ukrainian conflict, which has led Russia to vigorously promote its own local enterprises, wheat, as an important agricultural product for Russian exports, is also an important means of obtaining foreign exchange in Russia, so in vigorously promoting the development of the Russian wheat growing industry, promoting a lot of policies to support the development of agriculture, the situation of wheat growing in Russia has only improved a little.

Table 3

Changes in arable land per capita in Russia in 2016-2020

|

Year |

Arable land (hectares per capita) |

Arable land (number of hectares) |

Arable land (% of total land area) |

|---|---|---|---|

|

2016 |

0.081 |

108116000 |

11.519 |

|

2017 |

0.0809 |

109226000 |

11.523 |

|

2018 |

0.0801 |

110852000 |

11.616 |

|

2019 |

0.0792 |

116523000 |

11.789 |

|

2020 |

0.0778 |

112644000 |

11.756 |

|

2021 |

0.0789 |

105667000 |

11.657 |

|

2022 |

0.0853 |

115487000 |

12.139 |

.png&w=640&q=75)