Introduction

One of the main urgent problems of the development of economic entities in the global economy is the coronavirus pandemic. Its manifestation generates financial risks and threats that are an obstacle to the economic security of the organization.

Special management strategies are necessary for any enterprise affected by the crisis. Crises can come in many forms, such as the COVID-19 pandemic. The pandemic poses a serious threat to people, businesses and economies around the world. While governments are taking significant steps to combat the coronavirus, companies are rapidly adapting to the changing needs of their employees, consumers and suppliers, while addressing financial and operational challenges.

A crisis, regardless of its form, has the potential to threaten the success of a business and adversely affect its finances. Therefore, effective methods are needed to enable businesses to survive during it. The arrival of the virus led to the onset of a new economic reality, to which every economic entity needs to adapt, regardless of the scale: within a region, country or the whole world. Such facts indicate the unconditional relevance of the chosen topic.

Methods

The study is based on the application of a systematic approach, which made it possible to identify the main approaches to reducing the economic risks of a business, as well as the growth of the company's performance indicators in the global market. Content analysis of scientific literature and statistical reviews on the topic of the study, as well as periodicals of Russian and foreign authors, made it possible to assess the current state of affairs in the fight against coronavirus. The method of comparative analysis made it possible to evaluate the effectiveness of measures applied in different countries. The strategic approach made it possible to substantiate the company's activities to eliminate the economic consequences of the coronavirus infection. The main methods involved in the study are: analysis and synthesis, comparison, generalization, deductive and inductive methods, design and modeling, the products of the combined use of which are the creation of a concept for a company to overcome the crisis caused by a new coronavirus infection.

Results and discussions

The analytical service of the international audit and consulting network "FinExpertiza" analyzed data on closed companies in Russia. Already in the first half of 2020, 515,500 commercial organizations, or one in six companies, ceased their activities. The number of closed companies is 2.4 times higher than the number of newly created ones, which is the worst ratio for at least the last 18 years [1].

According to tax statistics, the registration of new enterprises slowed down even more significantly, decreasing by 24% (in total, 214,600 new enterprises were opened in 2020) [2]. In the face of quarantine restrictions, reduced demand and general uncertainty, people were in no hurry or simply could not start their own business, analysts say. The document clarifies that the data of the Federal Tax Service on the registration of commercial legal entities in the State Unified Register of Legal Entities was used. When calculating established and closed enterprises, reorganized enterprises were not taken into account (they account for approximately 1% of all legal entities registered and excluded from the Unified State Register of Legal Entities of the Russian Federation (Commercial Register)) [3].

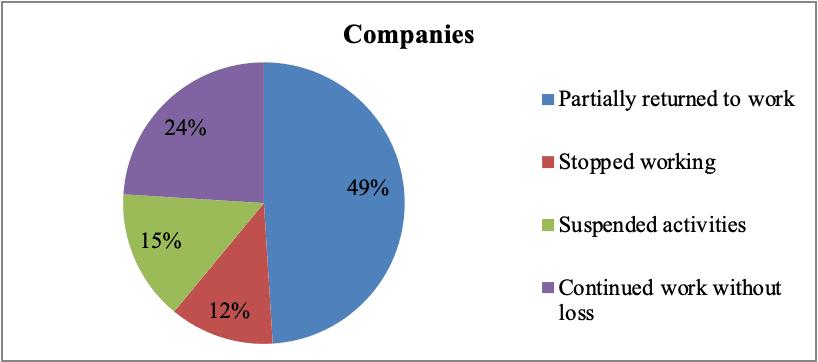

The author conducted his own research, in which more than 1000 companies operating in the EU market, as well as Russia and the USA were interviewed. Thus, among the companies surveyed, coronavirus restrictions have significantly disrupted the normal course of their activities. The most serious problems are observed in the framework of trade operations. More than half of the respondents note that they will not be able to return to pre-quarantine levels of indicators soon, as 49% of companies have only partially returned to work, and 12% have not returned at all. And 15% had nothing left but to temporarily suspend their activities, and only 24% of the surveyed enterprises were able to continue their work without loss.

Fig. 1. The position of small and medium-sized companies in the EU, Russia and the United States during the coronavirus pandemic

According to a joint study by NAFI and Forbes, conducted in June 2020, 76% of companies announced a decrease in revenue, 66% – a decrease in demand, 36.5% – a reduction in the number of suppliers. Entrepreneurs approach the issue of normalizing the situation very pessimistically. According to NAFI polls, only 43% of businessmen consider it possible to restore within a period of at least a year, about 14% estimate the recovery period within two to three years. According to the CSR15, by the summer of 2021, the share of recovering companies will be only about 66%. At the same time, 15% of companies are not sure whether revenue will reach pre-crisis levels by 2023.

At the same time, the main factors that negatively affected the efficiency of the business activities of companies are: quarantine measures to restrict the actions and life of people (56% – according to respondents), which leads to disruption of socio-economic processes. For example, quarantine has led to the fact that the economy of developed countries began to weaken in general, including in the context of individual regions; a decrease in the purchasing power of the population (54% according to respondents), since according to Eurostat, the real disposable money income of the population in the second quarter of 2020 fell by 8.4% in annual terms. An important role is played by the collapse of world markets during the first three months of the year. Some securities lost 80% of their value, which is confirmed by the chart in figure 2, where a technical analysis of the S&P500 index was carried out.

Fig. 2. Dynamics of the S&P 500 price index (as of 03/20/2020)

As you can see from the example of the S&P500 index, there was a 32% drop in stocks by March 20, 2020 from the previous high. At the same time, the current fall has set a historical speed record: a drawdown of 20% from the maximum was achieved in just three weeks.

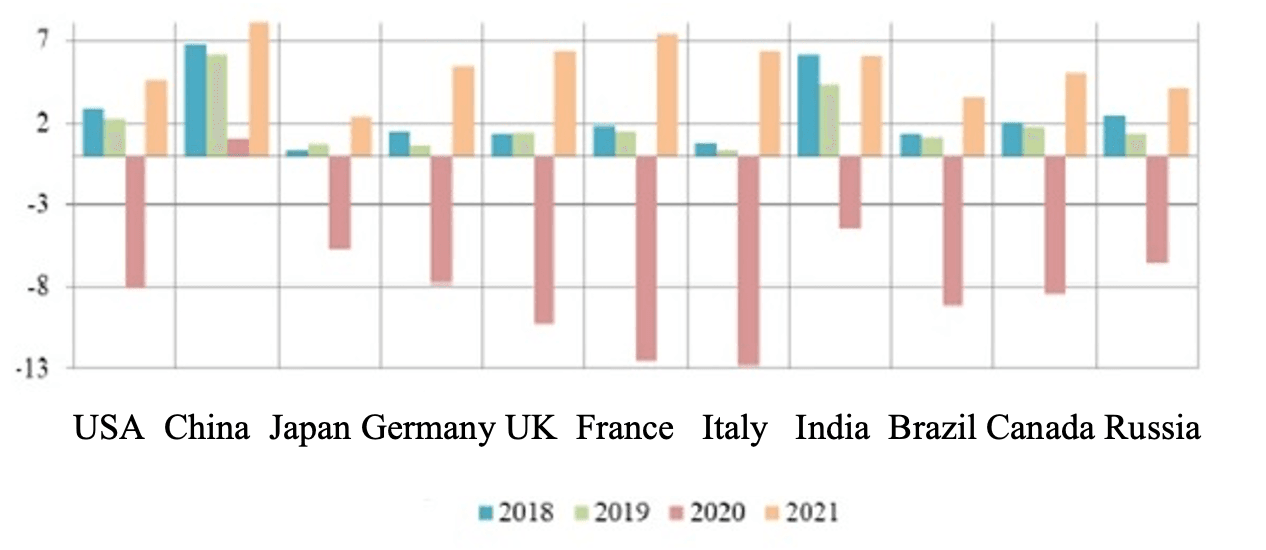

Constant updating of data indicates a deterioration in long-term forecasts and that the situation in the present is more complex than previously estimated. This situation was very clearly described in the title of the June 2020 IMF Bulletin: “A Crisis Like No Other” [4]. By the way, the IMF itself has significantly revised its forecast in an unfavorable direction. Thus, in accordance with the IMF forecast, in 2020, positive GDP growth will continue only in China (fig. 3).

Fig. 3. Actual and forecast GDP growth/decline, % (Source: Compiled by the author based on IMF data)

The first and second quarters of 2020 for many countries were associated with several types of crises at once, both in the economic field and in the field of health care. According to the latest forecasts, all regions of the world will be affected by the decline in economic activity. Differences in the scale of the decline, in addition to previous trends, reflect both trends in the spread of the virus and the impact of the containment strategy, as well as the proportion of affected industries in the economy. The current situation is also affecting investors' risk appetite, causing capital flows to change direction, as well as significant pressure on emerging market currencies, all in the face of fiscal constraints on support measures.

For management companies in this period of time, the following important task has been formed – to develop a comprehensive mechanism for managing risks and threats that adversely affect the functioning of the business, its financial stability and economic security. And in order to implement it, a clear understanding of the available risk management methodology in managing financial risks is necessary. Figure 4 schematically depicts the sequence of the procedure for the formation of a policy for managing the financial risks of business activities.

Fig. 4. The main stages of the procedure for the formation of a company's financial risk management policy

The key stage in the procedure for forming a company’s economic risk management policy in the context of a pandemic and economic crisis is the analysis and assessment of the magnitude and degree of the impact of risks in corporate finance, since it is the latter system that acts as the basis and foundation for the stability and success of the business activities of business structures. Financial risk assessment is a management stage that determines the degree and level of impact of the threat, what consequences it can lead to and what “price” the company will pay if it is not resolved.

Various approaches can be used to assess financial risks, including:

- quantitative methods;

- qualitative methods.

The advantages of quantitative methods for assessing financial risks are the objectivity of the results obtained and the ability to separately assess the degree of impact of each risk. The disadvantages are the complexity of financial calculations of the impact of risks [4].

The advantage of qualitative methods for assessing financial risks is the ability to assess qualitative threats that are not available in quantitative methods. However, the disadvantage is the subjectivity of the results obtained on the basis of an expert assessment.

When analyzing the impact of financial risks during the coronavirus period, the following areas of their impact on ensuring the economic security of a business can be distinguished:

- The coronavirus pandemic leads to the formation of currency risks associated with the instability of the national currency. There is a formation of financial risks due to the likelihood of an increase in the cost of implementing many investment projects. Thus, the process of renewal of fixed assets is slowed down.

- The pandemic has led to rising prices and a decrease in the purchasing power of the population. Sales volumes, revenues are decreasing, which means that the cash flow is slowing down, which increases the terms of the operating cycle of activities.

- The pandemic crisis leads to worsening conditions in the monetary market. The cost of attracting financial resources through bank borrowing is increasing. Thus, the company is faced with limited opportunities to raise funds to meet its investment and production needs.

- The share of overdue receivables is increasing, which leads to a decrease in the volume of inventory and stocks. The turnover rate of working capital is declining, which worsens the financial stability of the company.

Thus, in the context of the coronavirus pandemic crisis, a number of economic risks arise associated with a negative impact on the company's financial performance. The macroeconomic background has a negative impact on the economic activity of the business. An adequate anti-crisis approach should include special actions to minimize negative consequences. Consider the concept proposed by the author for the company's exit from the crisis caused by the COVID-19 pandemic (fig. 5).

Fig. 5. Steps taken to get a company out of the crisis caused by the COVID-19 pandemic

1. Do a stress test.

Stress testing is a method of analyzing and predicting the risks that enterprises are exposed to. This tool is one of the forms of testing the economic system, the purpose of which is to determine all possible results of the development of the system in the most critical conditions. The use of the stress testing tool in various areas of the economy has distinctive features that may vary depending on the specifics of the activity, the size of the enterprise, market conditions, etc.

Stress testing is based on the construction of exceptional models of possible situations in which an organization can theoretically find itself. This approach is often called "what - if" (what if). It allows you to evaluate various scenarios for the development of financial activities, identify weaknesses and determine the degree of preparedness for a crisis situation.

Stress testing includes elements of qualitative and quantitative analysis. Quantitative analysis is aimed at calculating possible changes in the main macroeconomic indicators, as well as assessing the impact of these fluctuations on the financial stability of the organization. Quantitative analysis methods allow you to determine the likely stress scenarios that may affect the organization.

Qualitative analysis in stress testing focuses on two critical tasks:

- assessing the ability of the organization's capital to compensate for possible large losses;

- determination of a set of actions the organization needs to reduce risks to an acceptable level and preserve capital.

The results of stress tests should be considered both as part of a set of risk management tools and when determining the amount of capital required to cover risks. As a tool for risk management and strategic planning, stress testing reveals the company's readiness for a crisis situation, assesses its weaknesses, and allows you to work out possible behavior strategies.

2. Make a forecast

The results of the stress test provide a temporal forecast: how long the company can operate in the same mode. If the company does not stop working at the expense of resources and a decrease in profits for a year and a half or two or more, then maybe there is no need to change anything. If the bill goes on for months, it is urgent to develop an anti-crisis plan, taking into account the financial risk management policy in the company.

3. Reduce fixed costs.

In a crisis, it is critical to cut fixed costs, including fixed salaries. If in the wage fund (PAY) 80% are fixed payments, and 20% are variable, then the company has little room for maneuver. A permanent payroll requires resources and reduces mobility. To do this, the permanent part of the payroll, which does not depend on the results, must be reduced to 30%. This can be achieved by changing and optimizing organizational structures. The crisis is the time when it is necessary to reconsider the organizational structure of the enterprise. In doing so, it may be appropriate to reduce the organization to the minimum necessary for survival, and then rebuild it from scratch.

In its simplest form, the organizational design and hierarchies within a company must meet the levels of centralization and streamline all business processes. To perform each business function, you must use the minimum resources required for the job.

In a more complex version, organizational design should take into account the perspectives of the entire enterprise, including:

- changes in the composition of top managers;

- rethinking the role of the corporate center;

- creation of a center of excellence for the use of existing opportunities and continuous improvement of the enterprise.

Today, in a typical company, most direct reports to the CEO are not directly responsible for P&L. Instead, they serve as a link between core business operations and the CEO, or are operational and functional leaders.

To achieve growth in a crisis, most companies need to clean up their structure to create business segments that are more empowered, smaller in number, and smaller in scale. They should eliminate most complex operations and reduce their corporate functions to focus only on protecting the enterprise in a crisis and maintaining standards of work.

Moreover, they should create new leadership roles, including positions related to digital opportunities, big data and analytics, innovation, new business models, and customer experience.

This step will allow not only to accelerate the development of the enterprise and increase its profitability when overcoming the crisis, but also simplify the organization itself in order to make anti-crisis management decisions more quickly.

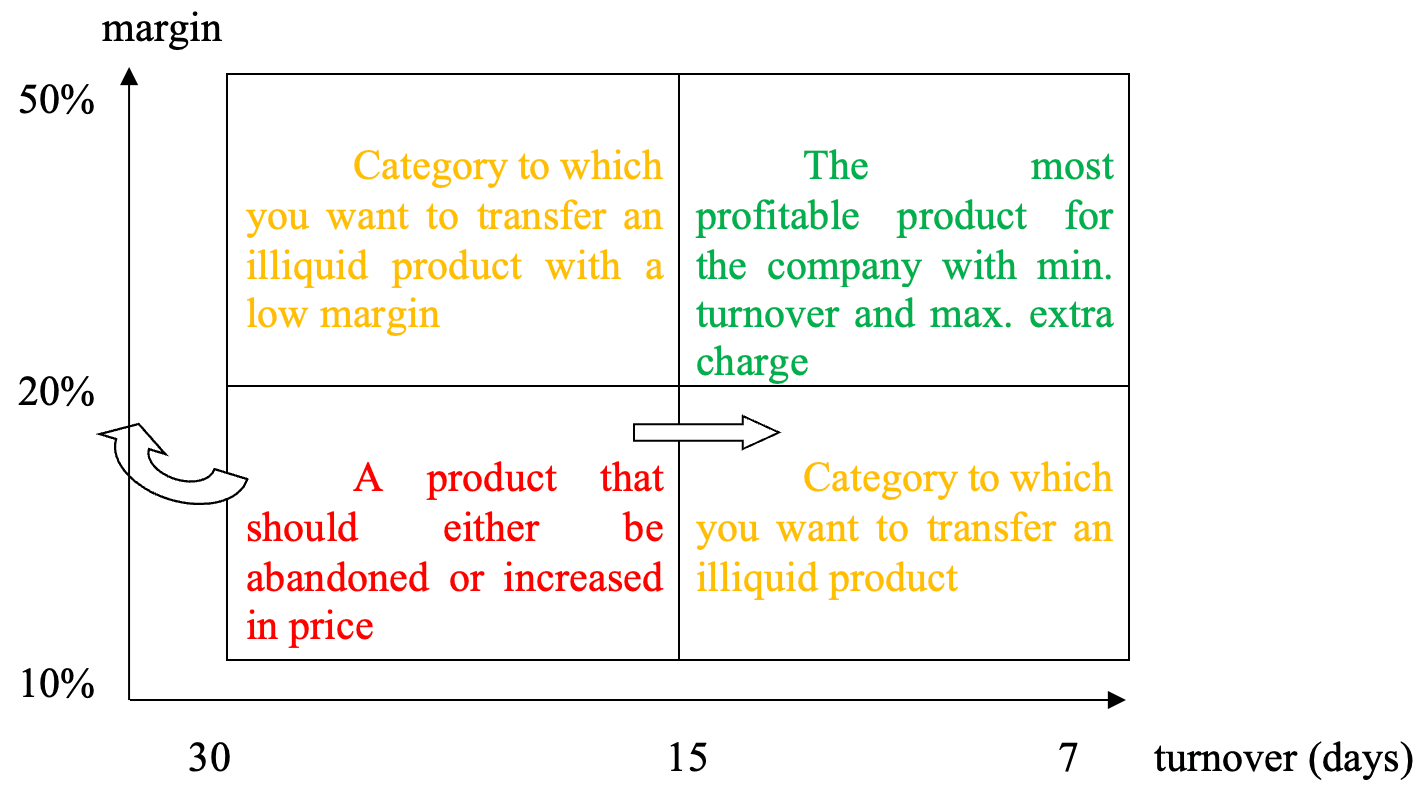

4. Turnover analysis.

In crisis conditions, it is not so much the absolute amount of working capital that is important, but the speed of their turnover: the slower the turnover, the more resources are required for the smooth running of business. To speed up the turnover, you need to analyze the financial cycle, find out the turnover by company areas, assortment, projects and customers. After that, “embroider slow sections”, remove “long” positions. It makes sense to increase sales during a crisis only in the segment of positions with a short cycle, fast turnover.

The inventory turnover matrix (figure 6) shows how to adjust the assortment for maximum benefit. The diagram shows tactics based on two indicators: business activity ratio and trade margin. It is necessary to abandon the production of goods in the red zone and increase the volume of goods from the green zone.

Fig. 6. Inventory turnover matrix

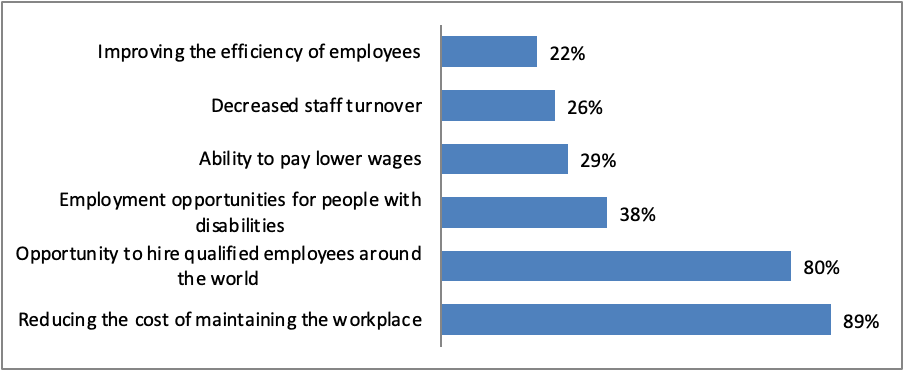

5. Switch to remote work.

After the company got rid of fixed costs, accelerated turnover, optimized the assortment, you can repeat the stress test. In this case, the company will already get better sustainability results. To manage a renewed business, you can use HR technologies that owners and managers of companies are looking at with hope in a pandemic: the work of full-time employees in remote access and the transfer of some functions to outsourcing. Figure 7 shows the benefits of remote work for companies.

Fig. 7. Benefits of remote work for companies

To evaluate performance, there are various time-tracking tools, programs installed on a computer to track the activity of employees: what applications and how long are active, what sites the employee visited. It is believed that the volume of work performed becomes more important, i.e. result of activities performed during the day. The reduction of communication losses is facilitated by the diagnostics of working time losses and “extra” employees, which is achieved using methods that allow determining the workload of employees, photos of the working day. It is important to revise labor standards when the implementation of the existing amount of work by fewer workers or in a shorter period of time is a model of savings. Outstaffing allows you to reduce management costs (recruitment, labor costs for accrual and payment of wages), but payment for the services of such a company is related to personnel costs.

Specialists of the Research Institute of Labor give forecasts about the further growth in the demand for remote work, since the remote format has shown its effectiveness in many ways. An analysis of foreign studies shows that many international companies supported this format even before the onset of the pandemic [6].

As enterprises implement the proposed changes, it will be necessary to evolve enterprise-wide. To support the new strategic model, it is necessary to rigorously implement change management practices in times of crisis.

The current crisis should not be a cause for concern, as it can be an incentive for the enterprise to develop more effective strategic solutions to other obstacles in the future. Crisis management is important so that businesses can better prepare for future crises and mitigate their impact, thereby maintaining the efficiency of their business.

.png&w=640&q=75)