A Comprehensive Overview of China’s Log Import Trade

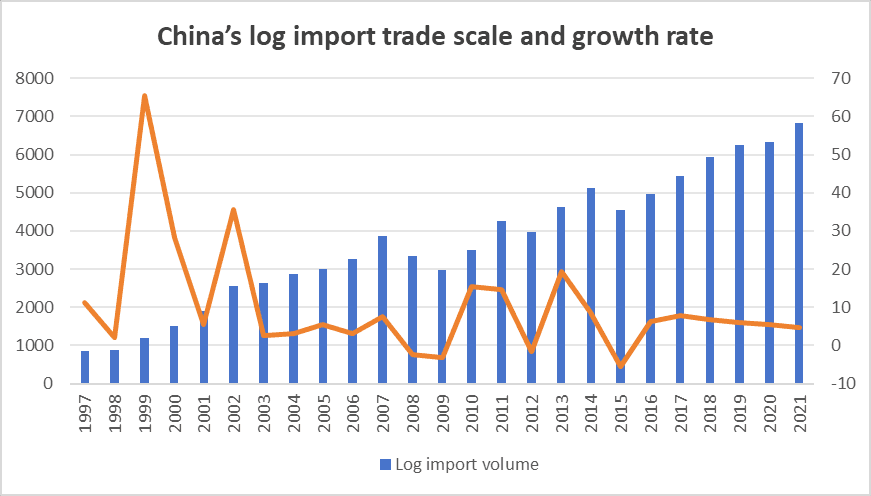

China's timber import trade reflects the dynamic interplay between economic growth, policy shifts, and global market dynamics. As the Chinese economy burgeons, so does its demand for timber. However, domestic timber supply falls short due to conservation policies, prompting an uptrend in timber imports (Figure 1). From 1997 to 2007, imports surged steadily, followed by fluctuating growth until 2021. Notably, coniferous timber saw a notable uptick post-2001, narrowing the gap with broad-leaved timber imports.

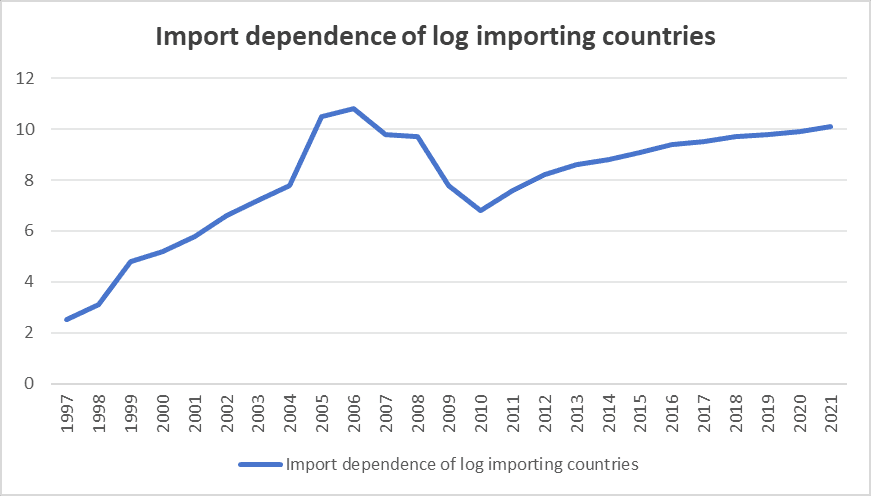

Timber import dependence, a critical metric, highlights China's reliance on foreign sources, exceeding 50% since 2007 (Figure 2). Higher dependence implies heightened vulnerability, accentuated by China's escalating timber import gap, reaching a historic peak in 2017. Volatility characterized pre-2002 import growth rates, stabilizing in recent years.

Fig. 1. The scale and growth rate of China's log import trade

China's global timber import dominance, evident in its 2020 share of 42.71%, underscores its pivotal role. Over the years, a three-phase evolution delineates shifts in import patterns. Initially, Japan led timber imports, succeeded by China from 2001 onwards. By 2010, China's dominance solidified, with Germany emerging as a key importer alongside fluctuating trends for other countries.

Fig. 2. Import dependence of log importing countries

Spatially, China's import partners and sources have diversified significantly. In 1997, imports primarily stemmed from Asian and African countries, notably Malaysia and Gabon. By 2007, a seismic shift occurred, with Russia dominating imports. The landscape expanded further by 2017, encompassing Europe and the Americas, with New Zealand emerging as a leading supplier.

China's import evolution witnessed a shift from tropical hardwoods to a broader range of timber sources, facilitated by policy adjustments and expanding trade networks. By 2017, the import spectrum encompassed a vast array of countries, mitigating risks associated with overreliance on specific regions or nations.

Analyzing Factors Influencing China's Log Imports

Timber imports into China are shaped by a myriad of factors, encompassing environmental, demand-driven, and supply-related elements, as well as tariff policies. Understanding these dynamics provides insights into China's timber import landscape.

Environmental Factors: Exchange Rates and Export Policies: Exchange rates play a pivotal role, influencing the competitiveness of timber imports. Fluctuations in exchange rates impact import costs, thereby affecting trade volumes. Stable exchange rate policies provide a conducive environment for timber imports, fostering market stability. For instance, when the Renminbi appreciates, import costs decrease, promoting higher import volumes. Conversely, depreciation elevates import costs, potentially dampening demand.

Export policies of timber-producing countries are another crucial determinant. These policies, directly regulated by governments, affect the ease and cost of purchasing timber. Take Russia as an example; its export policies aim to balance domestic processing and raw material exports. Policy adjustments influence the composition of timber imports, with shifts towards processed timber aligning with Russian policy goals.

Domestic and International: Domestic demand in China, driven by economic growth and rising consumer capacity, propels timber consumption. Increasing GDP correlates positively with timber demand, especially in industries like construction and furniture. The volume of new construction serves as a proxy for domestic demand, reflecting the need for timber in various sectors.

Internationally, China's role as a producer and exporter of wood products influences its timber imports. Derived demand for Chinese wood products abroad contributes to import dynamics. Plywood, wooden products, and furniture exports serve as indicators of foreign timber demand, reflecting global market trends.

Domestic Log Supply Factors: Domestic timber supply directly impacts import quantities. Forest stock volume serves as a critical indicator, reflecting a country's potential supply capacity. Policies regulating timber logging influence stock volume changes, thereby affecting import dynamics. Similarly, sawnwood production influences import quantities, with higher domestic production potentially reducing import volumes through substitution effects.

Tariff Policy: Tariff policies play a significant role in timber imports. China's progressive reduction of import tariffs, including the elimination of timber tariffs, has stimulated import volumes. Lower tariffs incentivize imports, contributing to increased timber trade.

The impact of the ban on the export of Russian logs to China's logs

The prohibition on exporting Russian logs to China has led to significant repercussions in the log import market, reshaping the structure of log import sources and triggering alterations in the log import market's dynamics. China, characterized by low forest coverage rates and limited per capita forest area, has historically relied on imports to meet its timber demands. Conversely, Russia, as the world's foremost in terms of forest coverage, had been a crucial timber supplier to China. The ban's imposition has disrupted this symbiotic relationship, necessitating China to diversify its sources of log imports.

The ban's impact is discernible in the fluctuation of log import sources, as evidenced by the data presented in Table 3-1. Prior to the ban, Russian log imports exhibited a consistent growth trajectory, indicating the nation's pivotal role in China's timber supply chain. However, with the ban's enforcement, Chinese log imports from Russia witnessed a precipitous decline, prompting China to augment imports from other countries such as Canada, Brazil, and New Zealand. This adaptation underscores China's capacity to recalibrate its log import sources, mitigating the supply shortfall resulting from the Russian ban.

In tandem with the altered import dynamics, the log import market faces heightened risks, as elucidated by Wei Tong's research employing the Armington substitution elasticity model. The dwindling substitutability between domestically produced and imported timber exacerbates China's import dependency, accentuating the market's vulnerability to external supply disruptions. This susceptibility is exacerbated by the disparity in export output elasticity among log-exporting countries, with some primary sources exhibiting lower supply security.

Moreover, the ban's repercussions extend to the price dynamics of log-related products, as depicted in Figure 3-1. The notable escalation in prices of furniture, construction timber, and paper products suggests supply constraints induced by the ban, compelling upstream raw material costs to surge. This price hike permeates the entire value chain, impacting both industry players and end consumers, accentuating China's susceptibility to global timber supply disruptions.

Furthermore, the ban has escalated the operational costs of log manufacturing enterprises, as illustrated in Table 3-3. The marked increase in raw material costs, exacerbated by the ban-induced supply constraints, underscores the challenges faced by enterprises reliant on imported timber. Concurrent rises in labor and energy costs compound these challenges, underscoring the multifaceted impact of the ban on the operational viability of timber manufacturing enterprises.

Analyzing the Effects of the Russian Log Export Ban on China's Timber Imports

This study employs a Difference-in-Differences (DID) model to assess the impact of the Russian ban on timber exports on China's import of raw timber from the United States. The model specifications are as follows:

![]()

Here, the subscript 𝑖 represents the HS8-digit customs code of imported logs, and 𝑡 denotes time. ![]() denotes the intercept term,

denotes the intercept term, ![]() represents the fixed effect of the product,

represents the fixed effect of the product, ![]() is the monthly fixed effect, and

is the monthly fixed effect, and ![]() it is the error term. 𝐿𝑛𝑦 represents the import of logs from China,

it is the error term. 𝐿𝑛𝑦 represents the import of logs from China, ![]() denotes the dummy variable of the Russian log export group, and

denotes the dummy variable of the Russian log export group, and ![]() represents the temporal dummy variable of the ban on the export of Russian logs. The interaction term, (𝐿𝑛

represents the temporal dummy variable of the ban on the export of Russian logs. The interaction term, (𝐿𝑛![]() ×

×![]() ), is the core explanatory variable of this paper, capturing the trade effects of the ban on Russian log exports.

), is the core explanatory variable of this paper, capturing the trade effects of the ban on Russian log exports. ![]() represents the control variables, with coefficients denoted by

represents the control variables, with coefficients denoted by ![]() .

.

The explanatory variables in this study include the total amount of logs imported by China, the average price of logs imported from Russia, and the total amount of logs imported from Brazil and other top 15 log-importing countries. China's log import market is divided into two categories: the Russian import market and the import market of 15 countries. The core explanatory variable is the intersection of policy and temporal dummy variables, capturing the impact of the Russian log export ban on imports from Russia and 15 countries.

Control variables include the real effective exchange rate of RMB, log production price index, forestry value added as a percentage of China's GDP, and the average import price of logs. These variables account for factors such as exchange rates, domestic and foreign market conditions in China, and the price level of logs, which may influence log import trade.

Data for this study covers the period from January 2016 to December 2022 and includes monthly import data of the first 24 HS8-digit log imports of China Customs. Additionally, data on log import value, import volume, and average import price from the top 15 major log importers are considered. The study utilizes data from various sources including the International Trade Research and Decision Support System, BIS, Guotaian database, and the World Bank Open Data.

Countermeasures for Chinese log imports in the context of the ban on Russian log exports

In response to the ban on Russian log exports, Chinese timber industry resilience necessitates a multifaceted approach. This paper outlines six countermeasures aimed at bolstering domestic timber supply capacity and diversifying import sources, while also accelerating the transformation and upgrading of the timber industry. Moreover, it underscores the importance of improving enterprise risk awareness and internal controls amidst the uncertainties posed by the ban.

Firstly, enhancing domestic timber supply capacity requires comprehensive resource protection and management policies. These encompass implementing a quota management system for land acquisition, curbing illegal deforestation, and fostering sustainable forest management practices. Concurrently, efforts must focus on increasing domestic timber production by establishing fast-growing, high-yield timber forest bases and nurturing middle-aged tree species.

Strategic timber reserve production bases emerge as crucial assets in mitigating the impact of the Russian ban. By adhering to rational management practices and drawing from international experiences, such as Germany's forest management models, these bases can enhance efficiency and income. Furthermore, investment in talent and technology is imperative to fortify timber supply capacity and ensure domestic sufficiency.

In addition to bolstering domestic capacity, diversifying import sources is paramount. An overseas development strategy, aligned with sustainable forest cultivation guidelines, is essential. This involves establishing cultivation and processing bases abroad, thereby mitigating reliance on Russian imports. Furthermore, exploring timber resources in stable countries like the United States, Canada, and New Zealand, as well as economically robust nations like Sweden and Germany, offers avenues for diversification.

Accelerating the transformation and upgrading of the timber industry is pivotal in navigating the challenges posed by the ban. Investment in high value-added products and digitalization fosters industry resilience by reducing dependence on raw timber. Moreover, optimizing the industry chain, fostering cooperation, and expanding domestic and international markets bolster competitiveness and reduce vulnerability to market fluctuations.

Amidst heightened uncertainties, enhancing enterprise risk awareness and internal controls is imperative. Establishing robust risk assessment mechanisms enables timely response to supply chain disruptions, while diversifying raw material sources mitigates dependence on a single supplier. Embracing flexibility and innovation in operations enhances resilience, while internal education and training instill a culture of risk management and crisis response within enterprises.

In conclusion, the strategies outlined offer a comprehensive framework to mitigate the impact of the Russian log export ban on the Chinese timber industry. By fortifying domestic capacity, diversifying import sources, upgrading industry practices, and enhancing enterprise resilience, China can navigate the challenges posed by external disruptions and ensure the sustainability of its timber sector.

.png&w=640&q=75)