The relevance of the topic concerning innovative ideas and their evaluation regarding their implementation in any project is explained by the fact that modern technology and science are at a stage of rapid development, when any entrepreneurial activity has become impossible without the introduction of the latest tools. Any innovative idea should be evaluated in terms of economic efficiency, demonstrating possible profitability and significance in a certain area. Therefore, the need to study the existing methodologies for evaluating the commercialization of innovations is considered as one of the most important stages of their introduction into the production process.

At the current stage of development of economic systems and processes, establishing and ensuring the effectiveness of the process of commercialization of innovations is considered an objective prerequisite that forms material values. Such a rule allows to create a new demand in the market of goods and services, taking into account possible costs, expenses and resource provision, shifting the focus from the production of enterprises to various areas of management [3].

Innovation is often described as a modern way of updating the life cycle of organizations. It is an opportunity for enterprises to show their results in commercialization of final products and enter a new market, taking a leading position.

In the context of theoretical understanding, the concept of “commercialization of innovations” represents the actions of the organization, which are promising in terms of commercial benefits from the implementation of a new project, idea and bringing it to the market, as well as the subsequent assessment of profitability. Considering the commercialization of ideas in STEM, it implies primarily the integration of technical and scientific engineering ideas into entrepreneurship and business [3]. The purpose of such transformation is to form new markets and improve the competitiveness of products. After all, in a difficult economic condition, innovation and technology have become the main means of solving social, economic problems in enterprises.

Despite the fact that the issues of innovative development of enterprises and business entities are widely described in scientific literature, still today there is a sufficient number of problematic points of the process of commercialization of innovations. For example, researcher B. Bousman believed that commercialization is successful where projects are more likely to lead to commercial benefits if they were initiated either by the research and development manager of the company or the top managers of this company [1].

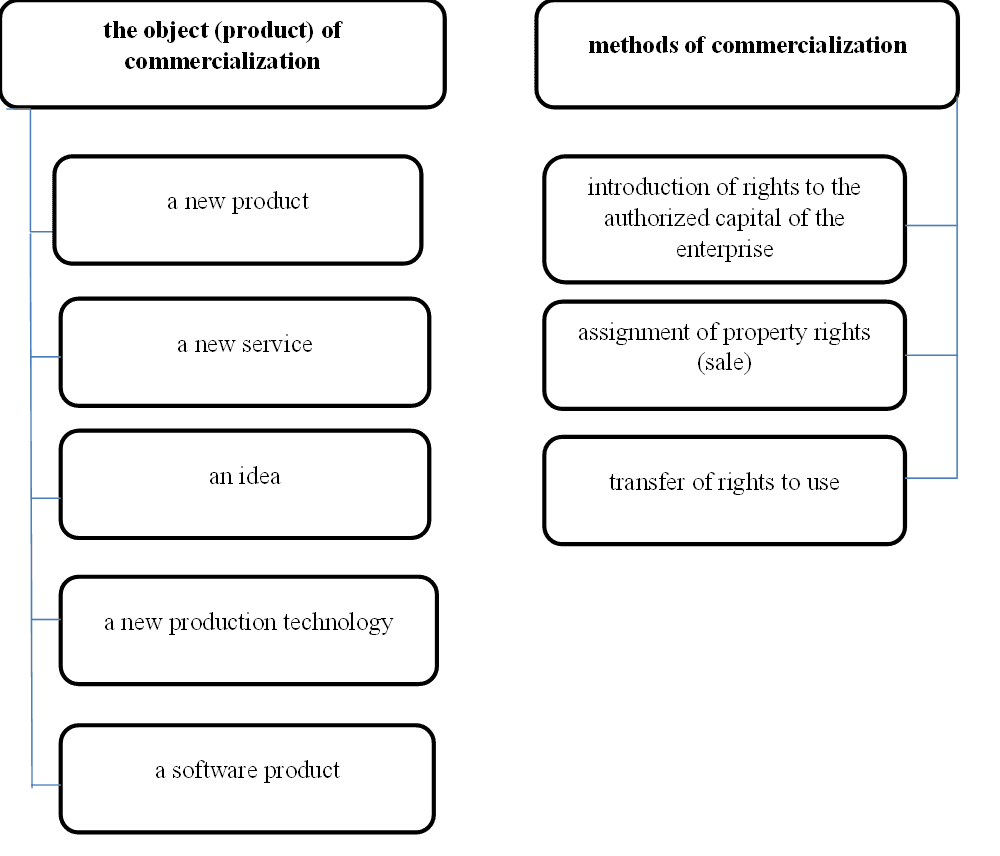

Commercialization of high-tech products is the process of creating, selling and marketing a high-tech product that can provide the expected economic benefits to the industry. Figure 1 shows the basics of commercialization of an innovation project [3].

Fig. 1. Fundamentals of commercialization

Overall, STEM innovation is critical to the development of society and the economy, influencing new technologies and creating new industries. However, despite their importance, research in this area is often neglected, and this lack of attention can have serious consequences, impeding progress and limiting the ability to address some of society's most pressing challenges.

Looking at the global experience, we can see that innovation in STEM fields demonstrates the aspirations of academics, particularly in the US, in creating and promoting scholarship for science and engineering students. The growth of research papers shows the increasing interest of young professionals in research. This contributes to high research output. The rapid development of STEM in the United States over the past decades has been greatly facilitated by both national policies and strong financial support from US government agencies as well as private funding sources [5].

Any innovative idea should be competently analyzed and evaluated in terms of economic efficiency. There are several popular methodologies for evaluating the commercialization of STEM innovations. Further it is worth to study each of them.

As is known, any sphere of entrepreneurship is to some extent associated with commercialization, since the goal is to increase the profit of the enterprise. At the initial stage, the generation of an innovative idea takes place. The process of commercialization takes place in several stages and ends with the launch of the finished product. At the first stage, any entrepreneur calculates the possible costs of implementing an innovative idea. In this case, quantitative and qualitative criteria are taken into account at the project stage. Criteria analysis makes it possible to calculate such indicators as profitability, payback period, net possible income [2].

Statistical methods of commercialization assessment involve modeling by structural equations, investigating linear dependencies between hidden (unobserved) and explicit (observed) variables. Such a technique combines a measurement model (comparative factor analysis) and a structural model (regression or path analysis) with simultaneous statistical testing [4].

The indicators of sales of innovative products can be considered as variables. The main tool is in this case the expansion of the customer base and the development of new markets. Quantitative assessment of the sales index can be carried out with the help of binary indicators, namely: if the share of sales of innovative products to the third largest customers in total sales is less than 25%, the index gets the value “1”, if more, it gets “0”. Accordingly, a satisfactory situation is assigned a single value, and an unsatisfactory situation is assigned a zero value [4].

Multiple regression analysis can be used to statistically assess the commercialization of innovative projects in STEM fields. The formula is as follows:

![]()

Where:

Y is the predicted commercialization success (dependent variable),

X1, X2, ..., Xn – independent variables (project evaluation factors),

β0 – constant (free term of the equation),

β1, β2, ..., βn – regression coefficients showing the amount of change in the dependent variable when the corresponding factor changes by one unit,

ε – model error, residual.

This method allows us to assess the impact of several independent variables (factors) on the dependent variable. In this case, it is possible to assess the success of commercialization of the project expressed through some quantitative indicator. Such an indicator can be the expected return on investment or sales volume [11].

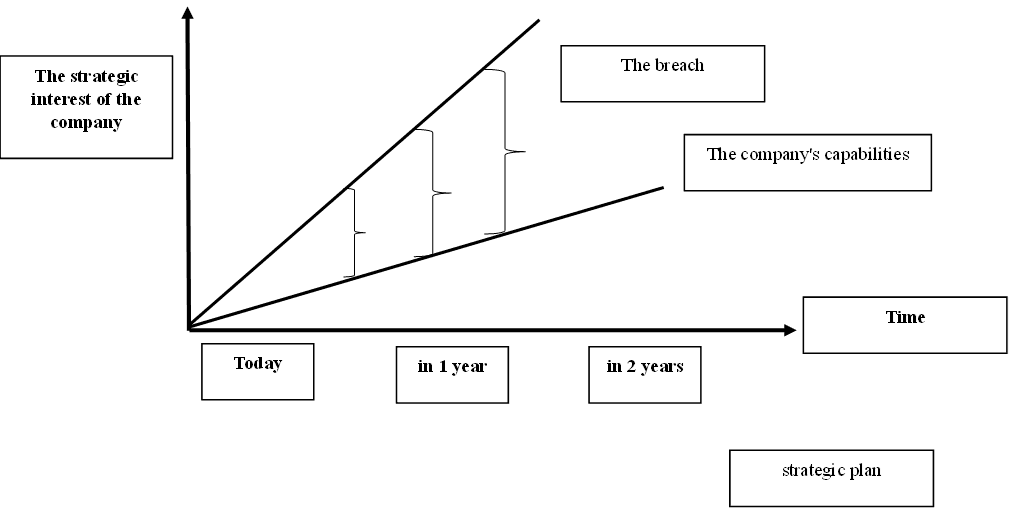

Another method of assessing the commercialization of innovations is GAP-analysis. This type of analysis involves comparing its current performance with the expected results after the implementation of an innovative idea. GAP-analysis is used to determine whether the company is meeting expectations and utilizing its resources effectively [10]. In this case, the company will be able to analyze its weaknesses by measuring the expenditure of time, money and manpower by comparing it with the target state. Also, GAP analysis for commercialization purposes can be used to evaluate the difference between assets and liabilities of a company that is sensitive to interest rates. Figure 2 shows the GAP analysis for commercialization assessment schematically.

Fig. 2. GAP analysis [10]

Two main variables indicators T (period) and S (expected economic effect) are analyzed at the intersection of the graph. The indicator T0 characterizes the current period of development of R&D activities of the company, and the line “time” - the trend of strategic development taking into account the innovation.

SWOT-analysis is one of the most common methods of assessment. The method of identifying weaknesses and strengths of an innovative idea or project within the framework of commercialization will help to assess the risks and opportunities after the introduction of new production technologies [7]. If, for example, the company has a rich history of innovation and is one of the leaders in the industry of commercialization of new products, then the consistent study of the internal state of the organization, the search for positive and negative sides, as well as predicting the expected opportunities or threats from the external environment of the innovative project of technology commercialization will help to conduct a qualitative diagnosis and make the right decisions.

Also, the assessment of economic feasibility of an innovative idea or project can be evaluated using the net present value method. In this methodology, the leading indicator (net present value) is the criterion of improving the welfare of the company's shareholders. The method determines whether the amount of discounted net monetary income during the economic life of the innovation exceeds the amount of discounted investment costs. The formula for calculation is as follows:

![]() ,

,

The final NPV (maximum positive net present value) allows the following decision to be made:

NPV > 0 – the project is considered

NPV < 0 – the project is rejected

NPV = 0 – the project is on the verge of profitability/loss and further analysis is necessary.

A fairly effective method is the method of estimating the internal rate of return (IRR). It is most often used as a comparison of several innovative ideas in order to choose the best one. IRR determines the effectiveness of the project in generating profit. Therefore, companies use this indicator for planning before investing in any innovative idea [11]. Threshold rate or required rate of return is the minimum return an organization expects from its investment. Any idea with an internal rate of return greater than the threshold rate is considered profitable.

If we use the formula to find the net present value, the internal rate of return will be equal to the discount rate in the following equation:

![]() ,

,

To evaluate the performance of an innovative idea using IRR, it is necessary to know what the market rate is. The interest rate at which a bank would lend can be used as the market rate. In this case, if:

IRR > r – the project is considered

IRR < r – the project is rejected

IRR = r – the project is at the profit/loss boundary.

Another method is called innovation payback period estimation. It is also widely used for commercialization of innovative ideas, because it allows you to calculate the payback period of the money invested in the innovation. If the monetary returns for the years are the same, the formula for determining the payback period is as follows:

![]() ,

,

Where:

PBP – payback period

IC – initial investment

NI – average net cash flow.

Further, there is a method of assessing the return on investment. This indicator reflects the return on investment of money for a certain period of time. It is also called ROI (Return on investment). This is the coefficient of return on investment and the payback ratio. The formula looks like this:

ROI = Profit for the period / Cost of investment * 100%

Where:

ROI – profitability ratio.

ROI shows the ratio of net profit (or loss) to total investment. It allows us to evaluate how effectively the investment in the project is turned into profit.

Next, Break-Even Analysis is calculated using the formula:

Break-Even Quantity = Fixed Costs / (Sales Price per Unit - Variable Cost per Unit),

Where:

Fixed Costs are costs that do not change with changes in production volume (e.g. wages, rent, construction equipment).

Sales Price per Unit is the selling price per unit.

Variable Cost per Unit is the variable cost that was spent to create the unit.

The indicator determines the point at which total revenue equals total costs, i.e. the break-even point of the project.

There is also a methodology for calculating Return on Equity (ROE - Return on Equity). The formula looks like this:

ROE = (Net profit for the year) / ((Equity at the beginning of the year + Equity at the end of the year) / 2) * 100%

With this method, you can measure the profitability of a company by showing how much profit the company generates from shareholders' money.

The next method is the calculation of market value multipliers (Market Multipliers). The formula is as follows:

P/BV = Capitalization / Equity,

This indicator includes such indicators as P/E (price/earnings), which allows comparing the value of a project or company with its earnings.

Although there are a number of methodologies available, but it is worth saying that there is no single framework yet to assess the commercialization of innovative ideas in STEM that can be universally used by all participants in the innovation ecosystem to compare and bring innovations from different branches of technology, engineering and science to the same denominator.

The following proposes the author's Integrative Framework for Evaluating the Commercialization of STEM Innovations: A Universal Approach with Artificial Intelligence Implementation.

The convenience of this methodology lies in its universality, which allows to apply and compare innovations from different industries, and comprehensiveness, allowing to take into account all the necessary indicators of already existing methods. Adaptation with artificial intelligence will significantly reduce the timeframe for the implementation of innovations and increase accuracy in decision-making and risk assessment. The ability to accumulate a comparative evaluation base will allow establishing effective standards and criteria for evaluating innovation projects, thereby increasing the transparency and objectivity of the commercialization process.

This framework includes many parameters: from technological readiness and uniqueness of the idea to economic viability and market potential, providing a comprehensive tool for evaluation and planning at all stages of the life cycle of an innovation project. A key advantage of the framework is its flexibility and adaptability to different types of innovation and industry specifics, making it an invaluable resource for entrepreneurs, researchers and policymakers seeking to maximize the impact and success of STEM innovation.

The implementation of Artificial Intelligence in the Author's Integrative Framework for STEM Innovation Commercialization Assessment (IFOK) helps to dynamically adapt to changing conditions and trends by combining several key aspects that have not previously been implemented in a single systematic methodology:

- Advanced Analytics and AI for Trend Forecasting:

IFOC integrates the latest advances in data analytics and artificial intelligence to continuously monitor and predict future trends. This enables it to anticipate and respond quickly to new opportunities and threats, and adapt to changes in consumer needs and the technology landscape.

- Dynamic Ideation Mechanism with AI Involvement:

For the first time, a mechanism is introduced that automates the process of collecting, evaluating, and synthesizing ideas using AI-based tools. This provides the ability to evaluate ideas in real time, significantly accelerating the process of selecting and developing innovations.

- Systematic Incorporation of Sustainability and Ethical Considerations:

IFRC emphasizes the integration of sustainability and ethical principles into every aspect of the innovation process. This ensures that innovations are not only technologically advanced, but also make positive social and environmental contributions.

- Ecosystem Integration and Open Innovation:

Creating a platform for collaboration at all levels, from local start-ups to international research institutions and corporations. This encourages the sharing of knowledge and resources, opening new pathways for co-development and commercialization of innovations.

- Flexible Implementation and Monitoring Planning:

The IFRC adopts a flexible approach to project implementation planning and monitoring, allowing it to quickly adapt to changing conditions and implement adjustments to strategy based on data and feedback from the market.

These aspects together create a powerful innovation approach that not only generates and rapidly realizes new ideas, but also ensures their sustainable and ethical development and deep integration into current and future ecosystems. This opens up new horizons for sustainable and socially relevant innovation in various fields.

The main elements of the IFOK:

Identification of innovation potential:

- Automated analysis of market demand, technology trends and competitive environment using AI to assess innovation potential.

- Assessment of uniqueness and novelty of the solution through comparison with a database of patents and scientific publications.

Technology Maturity and Operational Readiness:

- Applying AI to analyze the technological maturity of a product and its readiness for mass production.

- Developing recommendations for product improvement and scaling.

Protecting Intellectual Property:

- Automating the process of searching and analyzing existing patents and research papers to determine if an innovation is patentable.

- Strategies for protecting intellectual property using AI.

Market Analysis and Commercialization Strategy:

- Using machine learning algorithms to segment the market, analyze target audiences, and identify potential sales channels.

- Determining pricing and promotion strategies based on data collected and analyzed by AI.

Financial Planning and Risk Assessment:

- Financial flow modeling and ROI assessment using AI, including revenue forecasting and NPV (net present value) calculation.

- Risk analysis and development of risk minimization strategies using artificial intelligence.

Monitoring, Evaluation and Adjustment of the Strategy:

- Developing a system of KPIs (key performance indicators) to monitor commercialization success.

- Using AI to continuously analyze market data, user feedback and product performance to quickly adjust the commercialization strategy.

Each KPI is rated on a 10-point scale, where 1 represents “very low level” or “very poor implementation” and 10 represents “highest level” or “perfect implementation.”

Stage 1: Innovation Potential (Maximum 20 points)

Uniqueness and Novelty: ___ / 7

Technological Maturity: ___ / 5

Intellectual Property Protection: ___ / 4

Strategic Analysis (SWOT, GEO): ___ / 4

Stage 2: Market Analysis (Maximum 20 points)

Target Market: ___ / 10

Competitive Analysis: ___ / 5

Demand and Consumer Preferences: ___ / 5

Step 3: Business Model and Strategy (Maximum 20 points)

Monetization Model: ___ / 6

Pricing and Distribution: ___ / 4

Marketing Strategy: ___ / 5

Risk Assessment (Regression Analysis): ___ / 5

Step 4: Financial Planning (Maximum 20 points)

Cost Estimation and Budgeting: ___ / 5

Revenue Forecast: ___ / 5

Risk and Sensitivity Analysis: ___ / 5

Financial Metrics (NPV, IRR, ROI, PBP): ___ / 5

Step 5: Implementation Planning (Maximum 10 points)

Prototype Development and Testing: ___ / 5

Implementation and Scaling Plan: ___ / 5

Stage 6: Monitoring and Evaluation (Maximum 10 points)

Capital Efficiency, ROE, Breakeven Point: ___ / 5

Market Feedback: ___ / 3

Strategy Adjustment: ___ / 2

Final Score: ___ / 100

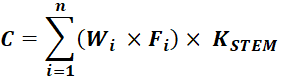

For a more accurate approach to evaluating the commercialization of STEM innovation projects, we will introduce factors for each of the main evaluation criteria, as well as the KSTEM factor, which leads to a common denominator and allows us to compare projects from different STEM fields.

Factor Formula for Calculating Commercialization:

Where:

C – calculated commercialization indicator.

n – total number of criteria.

Wi – weight coefficient of the i-th factor, reflecting its importance for the commercialization of the project.

Fi – value of the i-th factor obtained as a result of the project analysis.

KSTEM - a coefficient that adjusts the commercialization assessment taking into account the specifics of the industry within STEM (science, technology, engineering, mathematics). This factor allows equalizing the comparison conditions for projects from different sectors, taking into account their industry specifics and market potential.

In this case, factor coefficients are established using expert assessments or analytical methods and AI (e.g., hierarchy analysis) assesses the degree of influence of each factor on commercialization success. To bring the factors to a common scale, the sum of all factors must equal 1.

Example of Factor Setting:

- Uniqueness and Novelty: F1 = 0.25

- Technological Maturity: F2 = 0.20

- Intellectual Property Protection: F3 = 0.15

- Market Analysis: F4 = 0.15

- Business Model and Strategy: F5 = 0.10

- Financial Planning: F6 = 0.10

- Implementation Planning and Monitoring: F7 = 0.05

Thus, projects can be evaluated by taking into account the specificity of the innovation and its relevance to market requirements and expectations. The factor model allows to dynamically adapt the evaluation process to the specific conditions of project implementation, which increases the accuracy and validity of decisions on the feasibility of investment and commercialization of innovative developments.

Let us assume that the factor formula gives a certain commercialization indicator C, which is the sum of weighted factors involved in the calculation. The result C can be an absolute number reflecting the commercialization potential of the project. To convert the result of the factor formula for calculating commercialization into percentages, we use an algorithm:

- Normalization of the result: Let's determine the maximum possible result Cmax, which can be obtained in the factor model. This can be the sum of the maximum values of all weighted factors, assuming that each factor reaches its maximum.

- Calculating the percentages:

![]()

Where:

%C is the percentage of commercialization potential of the project.

C is the calculated commercialization rate.

Cmax is the maximum possible commercialization rate in the model.

This approach converts the absolute commercialization rate into a percentage that reflects how much of the innovation project's potential has been realized relative to the maximum possible scenario. The conversion to percentages can be particularly useful when comparing the potential of different projects, as it provides a visual and easily interpretable representation of the estimates.

In this way, projects can be evaluated regarding the specifics of the innovation and its relevance to market requirements and expectations. The factor model allows the evaluation process to be dynamically adapted to the specific conditions of project implementation, which increases the accuracy and validity of decisions on the feasibility of investment and commercialization of innovative developments.

Such a model will help to conduct an analysis of the commercialization of an idea independently, without resorting to complex calculations and reducing costs and risks.

The use of artificial intelligence within this framework not only accelerates data processing and analysis of market trends, but also makes it possible to predict future changes in consumer preferences and technological innovations, thus providing valuable insights for the development and implementation of new products and services. Such an approach opens new horizons for innovation activities, making the commercialization process more efficient and resilient to changes in the external environment.

Ultimately, the proposed framework is a revolutionary solution that combines best practices and state-of-the-art technologies to accelerate and optimize the innovation process. It offers a universal platform for analyzing, evaluating and managing innovation projects, making it an essential tool in the arsenal of everyone working at the intersection of science, technology and business.

Thus, we can conclude that the author's developed integrative framework for assessing the commercialization of STEM innovations is a universal approach with the introduction of artificial intelligence, which has not been used before to assess the commercialization of innovative ideas. The author proposes its application for both stand-alone use and AI implementation.

In the course of the work it is determined that the assessment of the commercialization of innovative ideas is important because it helps to minimize the uncertainty and risks associated with the introduction of innovations, and promotes a more efficient and focused use of resources aimed at achieving commercial success, as well as, helps to implement viable innovations sooner in life

In the process, the advantages of the author's framework have been identified and these are summarized as follows: The model is flexible and can be improved and augmented as needed,

- The model reduces risks,

- Combines effective existing valuation techniques,

- By introducing the KSTEM coefficient, it brings innovative projects from different STEM industries to a common denominator.

Also, the introduction of AI in this framework will allow to accumulate statistical information on a variety of innovations in the STEM field, to carry out calculations in a short period of time, to increase the accuracy of calculations and forecasts.

In general, the commercialization of innovative ideas is a new approach, a kind of strategy on the way to the emergence of new markets, goods, technologies, projects through cumulative actions to identify the most promising commercial solutions, starting from the idea itself and ending with bringing finished products to consumers. It is defined that in the context of STEM commercialization combines scientific development, technological projects, engineering and mathematics.

.png&w=640&q=75)