Acknowledgements for support to the Secretariat of Higher Education, Science, Technology, and Innovation (in Spanish SENESCYT), Postal Code: 1701518, Quito-Ecuador.

Disclosure statement. No potential conflict of interest was reported by the author.

Introduction

Despite several political disagreements and the position taken by the Ecuadorian side about the events in which Russia has been involved since February 2022, Ecuador remains for Russia the largest trading partner among the numerous countries of the Latin American region. Since Latin America is a sphere of strategic interests for the Russian side in the context of the formation of a new world order, in this regard, it is increasingly important to consider the main trends, as well as problems and areas for their minimization, including the development of ways to strengthen Russian-Ecuadorian economic cooperation.

In the Russian scientific literature, despite the rather wide interest in the issues of development of Russian-Latin American cooperation, there is a situation characterized by a rather narrow range of works on the foreign economic interaction between Russia and Ecuador. Certain issues of this interaction have been considered by such authors as: Davydova A., Karpovich O. [1], V.M. Kurganov, J.V. Morales, X.V. [2, p. 134-138] Savala P. [3, p. 6-9], Naranjo S. [4] Shkolyar N.A. [5, p. 6-17], Yakovlev P.P. [6, p-209-226]. The authors of this paper have studied the Russian-Ecuadorian foreign economic co-operation, but the works on the Russian-Ecuadorian foreign economic co-operation are few.

Main part

The basis of Russian-Ecuadorian foreign economic co-operation at the current stage of the world economy development. Diplomatic relations between Russia and Ecuador, based on which is built today and foreign economic co-operation between the parties, were established in June 1945, but the exchange of embassies took place only in 1970. A year before that, the Trade Agreement between the USSR and the Republic of Ecuador [7] was signed, which defined the main aspects of Russian-Ecuadorian foreign trade relations.

Since that period, Russian-Ecuadorian co-operation has been quite stable, mainly along the lines of peaceful conflict regulation, economic and educational co-operation. But the strongest impetus to the expansion of foreign relations between Russia and Ecuador was given by the government of Rafael Correa, who came to power in 2007. Correa, being a supporter of the "left turn" in the Latin American region and pursuing, among other things, the goal of getting away from serious dependence on the United States, began to purposefully implement a policy of full-fledged multi-vector cooperation, including with Russia and China. The period of Correa's presidency was the most favorable for the development of Russian-Ecuadorian relations, which reached a qualitatively new level: the Declaration of Strategic Partnership between the countries was signed (2009), the first ever official visit of the President of Ecuador to Russia was made, bilateral political contacts intensified, the nomenclature of exported and imported goods expanded, and inter-country trade turnover increased [8].

Under subsequent presidents of Ecuador, bilateral relations also developed at a stable pace, including in the area of economic co-operation. For example, a special Russian-Ecuadorian Intergovernmental Commission on Trade and Economic Cooperation (IGC) was established to, among other things, promote the development of relations between the parties in the areas of industry, investment, tourism, energy, space exploration and so on.

Features and problems of Russian-Ecuadorian foreign trade co-operation. In the last decade, Ecuador has been one of the five largest trade partners for Russia among all Latin American countries (in 2021 it was second only to Brazil). Traditionally, Ecuador is interested in Russia as a major market for agricultural products (98% of all Ecuadorian exports to Russia are agricultural goods). The largest share in this segment is occupied by bananas, flowers, crustaceans, and cocoa. According to Rosselkhoznadzor estimates, Ecuador supplied 1.3 million tonnes of bananas to Russia in the past 2023, against an average annual banana consumption in Russia of 1.6 million tonnes [9]. Today, Ecuador has a unique opportunity to expand its share of the Russian market, especially in such niches as fruit (mainly bananas and pineapples), agricultural raw materials, fish and crustaceans, and flowers.

In 2023, for the first time in the last four years, Russia purchased petroleum products (mainly fuel oil for marine engines) from Ecuador for $355,000, totaling 1,600 tonnes. In 2019, for example, only 0.7 thousand tonnes of fuel worth $287 thousand were purchased. In comparison, in 2023, Ecuador supplied the world market with about 2.7 million tonnes of petroleum products worth $1.1 billion [10]. Thus, we can conclude that Russia was the largest buyer of these products from Ecuador last year.

From Russia, Ecuador imports mineral products, chemical products, wood and pulp and paper products, metals and metal products, machinery and equipment.

In general, the indicators of trade cooperation over the last decade have demonstrated active growth rates, and the peak came in 2021, when trade turnover between the countries increased by 29%. Moreover, the export of Ecuadorian goods to Russia increased by 113.7% [11].

Despite the tightening of anti-Russian economic sanctions by the collective West and the rhetoric of the importance of Ecuador joining them, Russian-Ecuadorian economic relations continue to develop quite steadily. Aggregate data for 2023 has not yet been made publicly available by statistical agencies, but a 5.6% [12] increase in trade turnover was recorded for 2022. Nevertheless, the growth rate compared to 2021 in 2022 was not significant at all.

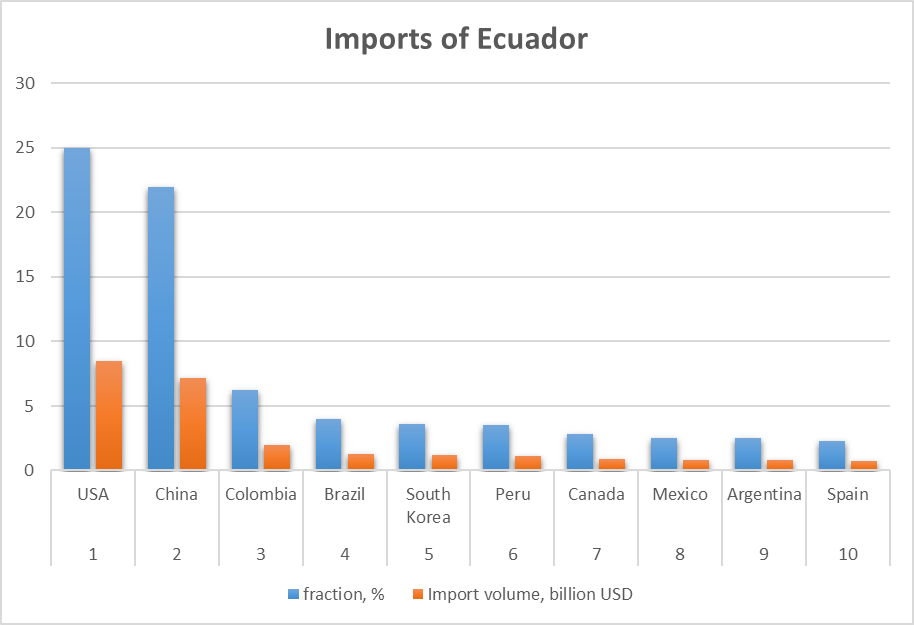

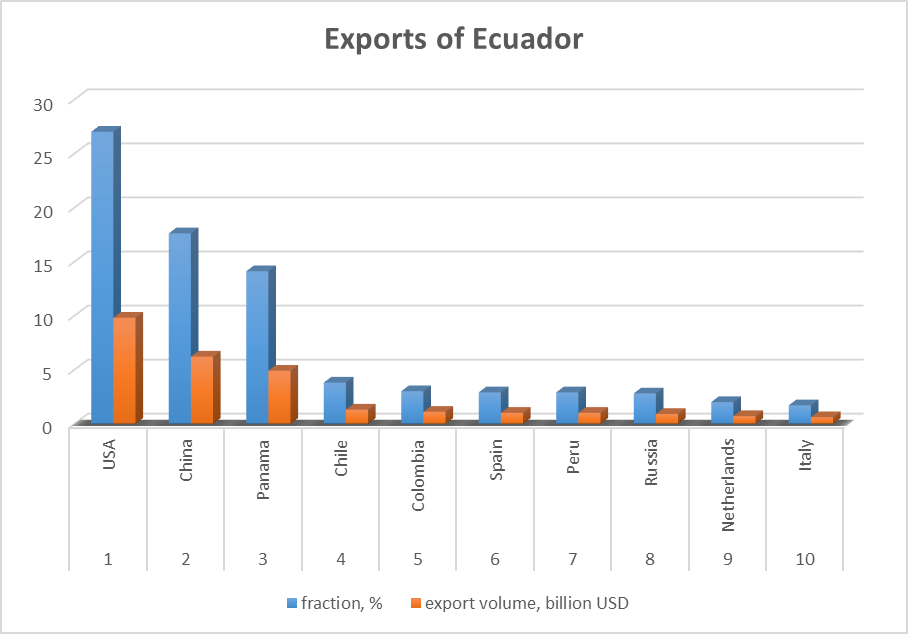

The key trading partner for Ecuador remains the United States, but the role of China is growing (fig. 1). As for Russia, in 2022 it was in eighth place among the countries with the largest volumes of Ecuadorian exports, while it was not among Ecuador's key trading partners for imports.

Fig. 1. Ecuador's largest import and export trading partners, 2022

Fig. 2. Source: compiled by the author from: Ecuador: World Trade and Exports [Electronic resource]. Access mode: https://trendeconomy.ru/data/h2/Ecuador

Logistical problems as a factor in reducing the pace of trade co-operation

Russian-Ecuadorian foreign trade cooperation has a number of problems, including in the area of logistics of Ecuadorian goods to the Russian market. Until 2022, the overwhelming majority of Ecuadorian exports to Russia were delivered through European hub ports, where they have been regularly blocked since the start of the ETS. This contributed to prolonged disruptions in shipments. In addition, it was not uncommon for ships carrying cargo to have to return, and Ecuadorian suppliers lost millions of dollars. In addition, since 2022, several international transport companies have refused to transport Ecuadorian cargo to Russia (for example, Maersk and Hapag-Lloyd, which organize the transport of bananas to Russian territory).

Today, the issue of developing alternative logistics routes, including through Chinese ports, as well as the Russian ports of Vladivostok, Bronka and Ust-Luga, is already being studied. The latter two are located west of St Petersburg in the Gulf of Finland. In our opinion, this work is still insufficiently carried out, although the issue remains relevant not only for Russia and Ecuador, but also for other Latin American countries that consider the Russian market as a promising one and plan to expand their presence there. The Russian company FESCO, which has an international status and transports cargo, including from Latin American countries, plays a significant role in solving logistical problems. Thus, in 2023, the company started working on a project to create a major transport and logistics center in the Leningrad Region.

It should also be noted that "dry ports" – logistics terminals directly connected by road or rail to a seaport – are also promising areas. One such project has been implemented in the Russian Far East (Artem) since 2014. The port's capabilities make it possible to receive cargo from Latin American countries and send it by rail to Russian cities, including central Russia.

In addition, it should be noted that the tightening of anti-Russian sanctions and Russia's disconnection from the SWIFT payment system have made it more difficult to export Ecuadorian products to Russia, and the price of the goods supplied has seriously increased due to additional costs. In this regard, the issue of pricing and maintaining high price growth for goods from Latin America, including Ecuador, also remains relevant.

Areas in the expansion of Russian-Ecuadorian investment co-operation. Investment co-operation is an important area of foreign economic co-operation between Russia and Ecuador, albeit at an extremely low level. Compared to American and Chinese business, Russian companies, except for isolated examples, are practically not represented in Ecuador. As an illustration of this thesis, we can cite the Russian companies Inter RAO and Tyazhmash JSC, which participated in the construction of the central station of the Toachi-Pilaton energy complex. In addition, we should mention Rosneft, which helped the Ecuadorian side in the exploration and development of oil fields. In 2021, Rimera Group, a Russian company that develops integrated engineering solutions for oil refining, opened a representative office in Ecuador.

In 2014, by signing an agreement between Russia and Ecuador on co-operation in the fisheries sector, work was initiated to expand joint co-operation between the Russian and Ecuadorian sides in the field of agriculture, namely fisheries. Since 2018, the two sides have attempted to expand this area of foreign economic co-operation by holding the first Forum of Russian and Ecuadorian Entrepreneurs. As part of the forum, the creation of the Russia-Ecuador Business Union was announced. It was expected that this would make it possible to strengthen information support for joint investment projects and attract new business representatives to co-operation in this area.

During the meetings of the Intergovernmental Russian-Ecuadorian Commission on Trade, Economic, Scientific and Technical Cooperation, the issues of expanding joint projects in the fields of energy, pharmaceuticals, railway transport, peaceful atom and space, and agriculture were considered. In 2023, the Russian Export Centre held events to inform Russian companies about working in Ecuador, including topics such as the specifics of the local market, prospects for exporting and importing Russian goods to Ecuador, specifics of logistics and customs clearance, and opportunities for potential buyers.

It should be noted that several factors impede more active development of Russian-Ecuadorian investment cooperation: the absence of a free trade agreement, high duties on Russian products in the Latin American market, insufficient interest of Russian business in the development of investment projects in Ecuador, and the strengthening of anti-Russian economic sanctions.

Prospects for the development of economic co-operation between Russia and Ecuador. Given the tightening of anti-Russian sanctions and Ecuador's need to maintain a balance between economic interests and dependence on the United States, Ecuador's policy towards Russia remains quite cautious. Despite a number of unfriendly steps towards Russia, the Ecuadorian leadership does not intend to reduce economic co-operation, primarily in the area of foreign trade. It should be noted that for the Russian side, the coming to power of the new president of Ecuador, Daniel Noboa, was perceived as an opportunity to strengthen bilateral cooperation. Nevertheless, realizing Ecuador's dependence on the United States, including in the economic sphere, Russia does not expect strong progress in foreign economic cooperation. Nevertheless, in February 2024, the Ecuadorian authorities announced that the country aims to strengthen investment cooperation with Russia, including increasing the number of joint projects. Thus, at a bilateral meeting, the Russian ambassador to Ecuador and the Ecuadorian president discussed "prospects for developing bilateral co-operation in a wide variety of sectors". Noboa "showed interest in almost all projects, both those frozen earlier and those with prospects." Today, the Ecuadorian Foreign Ministry is working out the details of all possible projects between the two countries, including within the framework of the work of the Intergovernmental Commission on Trade and Economic Cooperation [13].

In general, the potential of foreign trade relations and investment co-operation between Ecuador and Russia is still undiscovered. In our opinion, more interesting would be such areas of investment cooperation as the implementation of projects to open joint ventures in energy, machine building, and agriculture. By solving logistical problems, including by reorienting transport flows through Chinese and Russian ports, which will help minimize the risks that exist today, the opportunities for strengthening Russian-Ecuadorian foreign economic relations will be increased.

Projects in the field of digital technologies may be promising, and most Latin American countries today place a special emphasis on the development of these technologies, and Ecuador is no exception. There are examples of Russian companies operating in the digital technology market in Latin America: MFI Soft, Kaspersky Lab, SearchInform, Voximplant, Tsifra, and AiralabRus. Although these examples are isolated, they have great potential, primarily because of the optimal price-quality ratio.

It should be noted that despite some ambiguity in Russian-Ecuadorian foreign economic relations today, it is important, in our opinion, for the Russian side to continue to pursue the "soft power" policy that Russia adheres to in the Latin American region. Among the tools of this policy, diplomatic contacts, including the active work of the Russian Embassy in Ecuador, the expansion of programs in the field of culture and education, information work with Russian and Ecuadorian entrepreneurs to develop investment cooperation, and others should be highlighted. But despite Russia's "soft power" policy in Latin America, compared to China's work in this direction, Russia's policy can be assessed as insufficient. The Chinese side is characterized by more coherent, comprehensive, and large-scale work in this direction, including in the field of scientific, technical, educational and cultural contacts.

Conclusion

Ecuador is Russia's largest economic partner in Latin America, but a number of political contradictions, nevertheless quite understandable, prevent a more active unlocking of the foreign economic potential of both countries. Due to the tightening of anti-Russian sanctions and US pressure on Ecuador, uncertainty has increased in Russian-Ecuadorian foreign economic relations. The difficult situation of maintaining the political balance in which the Ecuadorian government is placed has so far prevented Russian-Ecuadorian co-operation from expanding at a more active pace. Against the background of the enormous potential of this co-operation, the great opportunities for Ecuador and the risk of missing these opportunities, one can note the extremely disadvantageous position in which the Latin American country finds itself today. However, the changing system of the old-world order and the formation of a new world order can already in the coming years make serious adjustments in the relations between Russia and Ecuador, but this will require finding solutions to several problems, including in the field of logistics, pricing, finding the most promising areas of investment cooperation, etc.

A certain base that has been historically formed in the sphere of diplomatic and then foreign economic relations between the two countries since the 70s of the last centuries, as well as the achievement of one of the leading roles of Ecuador among Latin American countries in foreign trade with Russia, are weighty factors for further and more active development of bilateral cooperation based on mutual respect and mutual benefits.

At present, Ecuador, like all Latin American countries, has unique opportunities to expand its share in the Russian market as companies of countries unfriendly to Russia withdraw from it. However, strengthening its position in the Russian market will largely depend on the political will of the Ecuadorian authorities and the active position of Ecuadorian and Russian entrepreneurs.

.png&w=640&q=75)