Introduction

Banks are traditionally highly regulated institutions, which are subject to strict legislative and regulatory control. This ensures the safety and reliability of financial transactions, but it also poses significant obstacles to innovation. Despite the rapid development of digital technologies, banks are not always able to take full advantage of their benefits. Compliance with regulatory requirements and data security concerns often make it challenging to integrate new digital solutions and processes, thus slowing down the rate of digital transformation within the banking industry. In order to comply with all regulatory requirements, banks must interact with customers in person. This leads to significant inconvenience for customers and substantial operational costs for banks. This article discusses the topic of automating banking processes, which typically require the physical presence of customers.

In this article, we will explore what a digital profile is and how it can help reduce banks' operational costs, using the example of the scenario of updating a client's personal information, which must always be kept up-to-date in accordance with FATCA (Foreign Account Tax Compliance Act) and CRS (Common Reporting Standard).

What is “Digital Profile”?

A digital profile is a comprehensive record of a person's or organization's data, including various types of registrations, documents, certificates, information on property ownership, travel within and outside the country, and more. The aim of this system is to provide authorized access to information held in other government databases. The digital platform includes a service that allows users to grant or withdraw permission for specific data to be shared with third parties [1, p. 207-218].

A prerequisite for the functioning of a digital profile is strict state-level regulatory control, as it may contain a significant amount of sensitive personal data about an individual. Unauthorized access to such information may pose serious risks.

Two conditions are necessary for obtaining data from a digital profile:

- A person's explicit consent to submit certain personal information for specific purposes of a specific company.

- A list of companies authorized to use data from the digital profile must be defined by relevant regulations. For instance, in the Russian Federation, this is a government decree such as "On conducting an experiment to enhance the quality and interconnectivity of data contained in government information resources" [2, 128-137].

What problems does the digital profile address?

It is crucial for banks to maintain up-to-date information on the passport details, address, and phone number of their clients, as well as a range of other personal data. This requirement stems from various normative legal acts, both nationally and internationally significant. In the absence of a centralized and reliable, most importantly legally binding, source of information, banks seek the necessary data and documentation directly from clients. Clients, in turn, are required to submit the necessary documents in person to the bank. This process poses additional risks and expenses for the bank, as documents may be fraudulent and require verification, and client identity must be reliably verified as well. Therefore, it is evident that the following main challenges are addressed by the digital identity solution:

1. Poor customer experience

Digital verification methods offer a more seamless and user-friendly experience for customers. They eliminate the need for physical visits to bank branches, reduce waiting times, and provide instant verification results, leading to higher customer satisfaction [2, p. 128-137].

2. Fraud

The digital profile provides data that has been certified by government authorities and has legal validity. In fact, it functions as an analogue to the paper version of a document. This significantly reduces the risk of data manipulation.

3. Increased operating costs

Digital identity verification technologies can lead to significant cost savings for banks. Traditional verification methods often involve manual processes, which are time-consuming and prone to errors. Digital methods, on the other hand, automate many of these processes, reducing operational costs [2, p. 128-137]. For example, for financial services providers, the cost of offering customers digital accounts can be 80 to 90 percent lower than the cost of providing physical branches [3].

How Digital Profile solves this issues?

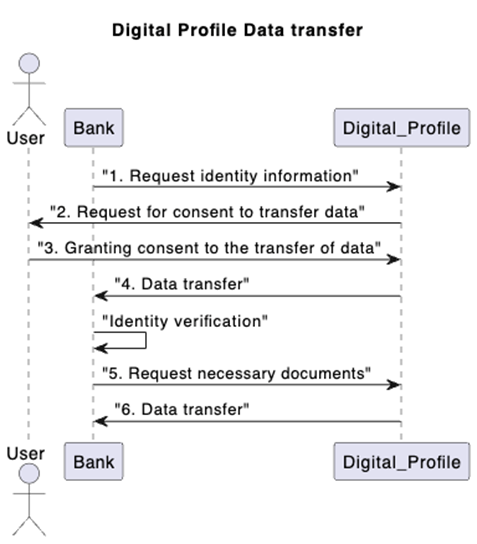

The most preferred method of integration between information systems is through the use of REST APIs. The process of retrieving the necessary data for their digital profile is illustrated in the diagram below (fig.).

Fig. Sequence diagram of data exchange with a digital profile

- The bank requires updating the customer's information, therefore it requests identity verification information from the digital profile.

- The digital profile requests permission from the user to transfer data to the bank.

- Upon receiving consent from the user, the bank transfers the identity document data to its system.

- Subsequently, the bank compares the received data with its internal database to verify the identity. If verification is successful, and it is confirmed that this is indeed the desired customer's data, the bank then requests a complete set of information from the digital profile.

- Upon receiving this request, the digital profile provides the necessary data to the bank.

In this way, the bank obtains the necessary data and utilizes it to provide services for its customers. As can be observed from the process, client involvement is only required for the granting of consent to data transfer, which can then be reused. Therefore, next time, the bank will be able to update data in a fully automated manner without any further involvement from the client. It is essential to manage the data updating process correctly, as there may be significantly different characteristics of data obsolescence depending on the type of document. For instance, an income statement may only be relevant for a single day, whereas a client's passport may need to be renewed every few decades.

Conclusion

The digital transformation of the banking industry, particularly in the area of identity verification, has been a revolutionary and challenging process. While these advances have brought about significant benefits, they have also raised new challenges that the industry must address in order to realize the full potential of these technologies.

It is clear that the future of digital identity verification in banking holds great promise. The convergence of various technologies offers opportunities for more secure, efficient, and user-friendly authentication processes. However, it is essential for the industry to be prepared to tackle the challenges that come with these advancements, such as security concerns, interoperability issues, and regulatory considerations.

As the banking sector continues on its path towards digital transformation, it will rely heavily on digital identification technologies. These technologies will play a crucial role in ensuring the integrity and security of transactions, as well as in enhancing the overall user experience. It is important for the industry to strike a balance between innovation and risk management in order to ensure success in this ever-evolving landscape. By understanding the advantages, challenges, and practical applications of these technologies, the industry can pave the way for a more secure and efficient future.

.png&w=640&q=75)